What Europe’s Gas Prices Mean For Renewable Energy Investments

Europe has sleepwalked into its first energy transition crisis, putting the “green revolution” at risk.

The Takeaway

Rising gas prices are a sign that Europe’s first energy transition crisis has begun.

We are unlikely to be able to solve supply problems in time to make a difference to climate change.

Reducing demand-side pressures will be a key area for governments.

Investors will need to carefully consider their long-term investments, particularly in gas.

Does your gas bill seem a little high too? If you’re in Europe, that’s because you’re experiencing the first real energy transition crisis. The European Union is seeing imported LNG prices in excess of $31.00 per million btu, with real concerns that households across Europe could be driven into fuel poverty this winter.

This has created a crisis of faith for the renewable energy sector, which has led to the European Union being forced to consider allowing coal-fired energy planets to operate for longer than intended. Increased coal usage would have disastrous effects, both for the climate, and for Europe’s credibility as a leader in the fight for net-zero emissions.

Why are we facing this challenge, and what can be done to minimize the impact of the energy transition crisis?

Europe’s Rush To Decarbonize Has Left Liquid Natural Gas Producers Out In The Cold

Fossil fuel investment has become a red flag with both European governments, and investors more generally. On the face of it this is a good thing, but there have been unforeseen consequences for one industry in particular, Liquid Natural Gas (LNG).

In theory, LNG projects should be receiving significant amounts of investment capital. LNG is one of the few fossil fuels considered “clean” enough (when properly extracted) to act as a transition fuel until renewables catch up, or the political discourse surrounding nuclear power shifts.

The problem is that despite being around, 45% cleaner than coal, nobody who is serious about fighting climate change sees any significant role for LNG in advanced economies by 2040. This makes investors unwilling to invest in a project that may shortly become obsolete, and customers wary of signing the long-term purchase agreements necessary to get projects off the ground.

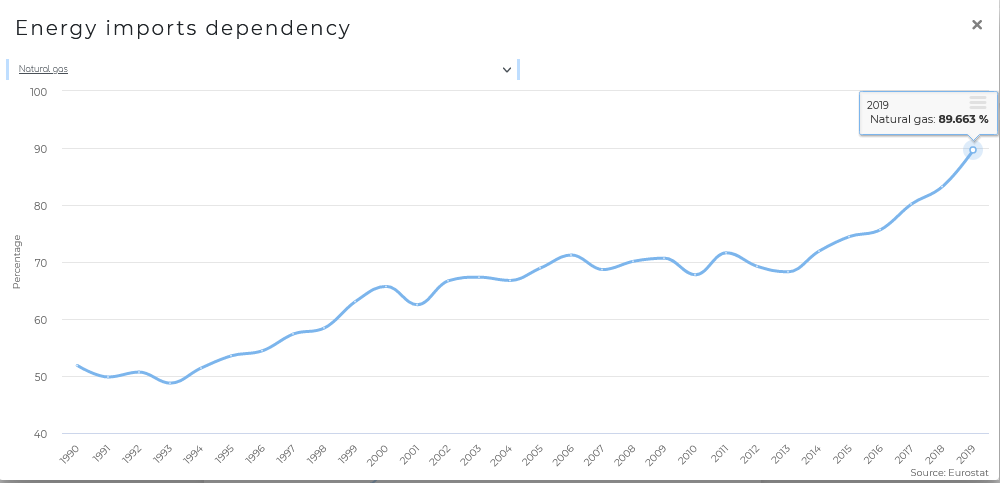

Gas prices are a big problem for Europe. The continent is reliant on imports for a staggering 89.6% of all of its gas needs. In the past this was less of an issue as gas import prices were relatively stable by region, but now things are beginning to change.

China and India, two of the world’s top three energy producers, are also undergoing their own energy transitions. China wants to increase its natural gas energy mix to 12% by 2030 and India wants to achieve a 15% natural gas energy mix by the same date. This means that both of these nations are investing in gas fired power plants without the ability to meet that demand domestically.

China might have the third-largest natural gas reserves in the world, but technical and geological limitations mean that the country is unable to produce enough gas to meet internal demands. India is also working on building its own strategic reserves, but this will take time.

The takeaway here is that there is now significantly more international demand for gas, with few countries able to supply enough to meet it. This means that Europe is competing globally to build its own gas reserves, and could be forced to weather high prices for a decade or more.

Short-Term Challenges Could Impact Renewables Investing

This is problematic for a number of reasons. The first is that it places nations at the mercy of the global market for their main supply of fuel. This will either spur governments to accelerate investment into new gas extraction methods, which will likely come at the cost of renewables, or to budget for significantly larger gas reserves, which may have the same effect.

Another issue, for Europe in particular, is that shale gas extraction is deeply controversial. It is known to have significant localized environmental impact, and can leave devastation in its wake if improperly managed. Another challenge is that shale gas extraction methods lead to significant amounts of methane being released into the atmosphere, which some believe was responsible for a spike in methane emissions in 2019.

Even a sudden about-face on nuclear energy might not be enough. Setting aside the challenges of disposing of nuclear waste, nuclear power plants are expensive to build and notorious for cost overruns (we’ll cover this in a future article). This means that they are unlikely to be able to come online fast enough to make a difference to reaching net-zero.

The crux of the issue is that increasing supply is incredibly difficult. New energy facilities are expensive and time-consuming to build. This means that governments and investors need to be looking at reducing demand.

Reducing Demand Is The Quickest Route To Solving Energy Transition Challenges

Supply and demand factors will always influence prices, but the fact is that demand-side pressures are typically easier to handle. There are some blunt, even Draconian, solutions on the table here, and we need look no further than China for some examples.

The first is China’s ban on Bitcoin mining. At this time this was viewed through the lens of capital controls, Bitcoin represented a threat to China’s control over money flowing in and out of the country. However, an often overlooked dynamic was the amount of power Bitcoin mining was draining from the Chinese grid. The ban freed up around 1% of China’s energy grid, that’s more energy than Belgium uses in a year.

China has continued this attempt to aggressively curb demand. The government has mandated energy limits for manufacturers. This has forced some factories to close down, which could have a significant long-term impact on the global economy in the form of goods shortages.

Other countries will undoubtedly look into doing the same. If demand for fossil fuels can be sufficiently cut, this could have significant implications for investors. The transition to net-zero could make half of the world’s fossil fuel investments worthless by 2035. That represents losses of $5.5 trillion.

Divestment From Gas Investments Might Be Necessary

There are two sides to this crisis; short-term opportunities created by gas shortages, and the long-term outlook of renewable energy investments. This creates a devious, and risky, strategy for any eco-investor: Leverage gas instability to create capital to invest in renewable energy projects.

The safest approach would be to invest in a globally facing natural gas ETF. There are a number of these, such as the U.S. focused United States Natural Gas Fund, LP (UNG) however European investors might want to use iShares (DE) I - iShares STOXX Europe 600 Oil & Gas UCITS ETF (DE) (EXH1.DE) instead. Both of these funds are designed to reflect the average gas prices in their region, and would offer a relatively safe way to take advantage of natural gas prices increases in the short-term.

The key will be to sell them before European governments successfully begin reducing natural gas demand. A solid strategy could be to take profit at regular price points, and then re-invest that money in renewables.

The next step would be to identify promising renewable energy projects to invest in. For the moment, any renewable energy ETF, such as iShares Global Clean Energy ETF (ICLN), will work. However, you can probably make a stronger local impact by investing in local renewable energy projects, such as wind farms or solar panels.

In any case, investors should begin offloading fossil fuel investments from their portfolio over the coming years in order to avoid getting caught out when demand for natural gas begins to plummet.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. Investing does involve risk, so caution must always be utilized. We cannot guarantee profits or protection from loss. You assume the entire cost and risk of any trading you choose to undertake. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.